I've been tracking the stock markets, global markets, builder quotes, industry watchers' opinions, and ofcourse the one important entity, the average man.

Based on initial analysis it is quite clear that unlike a bubble that manifests around a central point, the Real Estate story is quite asymmetrical. Instead of being focussed on a single entity, this ones' largely revolving around atleast five crucial elements, hence its' more of a "Pentabble" than a bubble :)

What am I talking about? Here are the five reasons around which the Mumbai Real Estate story is centered.

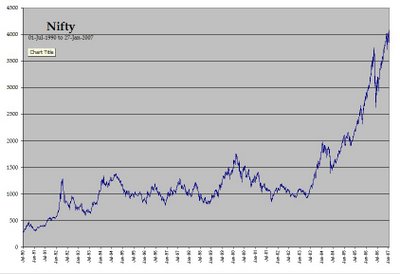

1. Collossal Influx of Capital in Early 06 (see Nifty90-07),

there is do denying that post Jul-03 there has been a steady inflow of investments, particulary from FIIs', Hedge Funds, Japanese Funds, Domestic SIP's, Insurance Companies and also to a large extent Indian Investors. This has resulted in dramatic value creation. This has led to a far better than expected surplus of funds for disposal at the hands of Indian Public, NRIs' and Corporations. This surplus has conveiniently found its' way into Real Estate. The presence of this surplus is confirmed strongly by the falling interest rates to ridiculously low levels like 7.0%-7.5% 1.1

there is do denying that post Jul-03 there has been a steady inflow of investments, particulary from FIIs', Hedge Funds, Japanese Funds, Domestic SIP's, Insurance Companies and also to a large extent Indian Investors. This has resulted in dramatic value creation. This has led to a far better than expected surplus of funds for disposal at the hands of Indian Public, NRIs' and Corporations. This surplus has conveiniently found its' way into Real Estate. The presence of this surplus is confirmed strongly by the falling interest rates to ridiculously low levels like 7.0%-7.5% 1.12. Indian Developers discovering the London Alternative Investment Market 1.2: Were you left wondering how on earth are developers able to command such high price? The answer cannot be simpler than this, "they source money way too cheap". Imagine a typical builder, he'd have to sell atleast a good part of his project before contemplating entering the market to buy extra TDR. However a smart builder sources funds from Londons' AIM, and then is able to sell ready-made flats in an almost "Auction House" model. They modus-operandi is quite easy actually, there exist a healthy nexus between property developers and estate agents, and its' not so difficult to find "investors" in a market of high capital availability. So you keep doing cross-selling till such time that prices are sky-high and at the same time they are generally accepted to be the real price. Although there is no citation for this, it stems from my personal account of being offered "investor" flats by the builders. These investors are nothing short than speculators who eventually pull up the price of a project, provided the developer can take it to completion by himself (with little support ofcourse).

3. Huge demand: Some basics dont change, there is no denying the fact that there is demand, but to say that this demand was generated in the last 30 months is foolish! This demand has certainly being recognised in that period but I wonder if its' actually being catered to! The demand is the underlying guarantee that prices will shoot-up and is also being used by investors to stay put in their investments.

4. Allowance of FDI in Reality: This has been one of the most disastrous decisions taken by UPA government, in March 2005. The effects of this are being felt more severly than ever! How can a government where communist parties are stakeholders make such a blunder? To deprive the common (even a middle-class common man) of the right to a good quality housing is the best way to be voted out of power for the current government. The hard work ahead for the opposition is to spread the word, and take this colossal mistake to the general public.

5. Corruption, Corruption and More Corruption: This is the primary source of black money, and this black money is the fuel for Real Estate! An actress who dates a businessman-scion of Raj-era goes on air proclaiming that she only invests in "Real Estate". A wee-bit of enquiries into the same would show the world what an "Heroine" is really made up of!

References & Links:

1.3: Click here for the latest on Mumbai's Real Estate Bubble

1.4: Compare your understanding of the Mumbai Real Estate to the following wiki article.

No comments:

Post a Comment