Very quickly, however I realised the sheer Opportunity Cost involved and has made me wonder Why anyone ever contemplates treating "Housing" Property as Investment Grade, leave aside Retirement Grade?

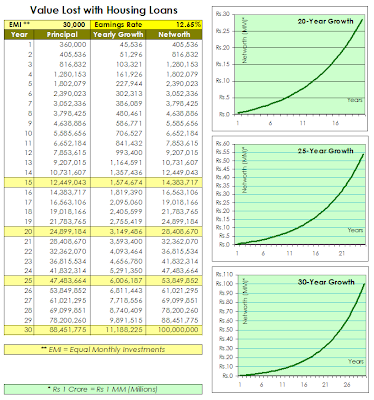

Lets analyse this "Opportunity Cost" element by considering a simple case. Imagine, a simple flat costing a paltry (4MM /or 40 Lacs) and is fully financed. You are looking at an "Net-EMI" of well over 45k p.m., but assuming the tax saver element (12.5k p.m), any rent you receive by letting out (~10k p.m.) and adjusting for society maintainence, repairs, pest-control, etc. we shall assume a NET monthly outgoing of 30k p.m towards this property. I do not know much about the direction Indian Salaries shall take, but sure do know that the purchasing power of Indians is headed North. So, you happily keep paying the "Net-EMI" till the maturity of the Loan, which would definitely be longer than the term you sign initially (interest rates are also headed north in the short term).

Now the question is what would you have after a period of 20-30 years?

The answers' quite simple you'd have a 20-30 yr old flat and ZERO - ZILCH - SHUNYA liquid assets. You can dispose off the property, however keep in mind, the price would likely be equal to current prices, if not less. Property prices are dependent on various factors current boom is due to Demand-Supply gap, doubling salaries, foreign investments are key drivers. However with rupee at its' all time low, it's envitable that it strengthens over a long term (20-30 years), and it means purchasing power of dollar weakens against the rupee. In such a scenario, investments in India would no longer be attractive, plus we'd have transformed into a semi-developed nation at the very least which means even lower interest rate. India would have a far better Credit Rating, and lesser Interest Rate. When that happens, you need to have Cold Cash, to be the king, not an old house, in an old building, with multiple tenant having multiple agenda.

Instead lets' look at an alternative scenario. Instead of using the 30k p.m. as "Net-EMI", you can use to periodically buy any / all of the following and creating a risk-averse basket, targetting roughly 12% p.a.

- Govt Bonds of those zillion "developing countries" (~10% p.a.)

- Corporate Bonds (12-15% p.a.)

- Mutual Funds (05%-50%)

- Stocks (-100% to 100%)

- Another gazillion investment options that our developing economy has made available.

With such a basket the portfolio is easily reaches a figure of 1.4 crores (15 yrs), 2.8 crores (20 yrs), 5.3 crores (25 yrs) and 10 crores (30 yrs). that's about the time retirement starts if you are about 30 now.

So clearly a piece of land + house in far off places, or a flat in one of our cities is not what an "Investment" is supposed to deliver, its' liquid assets, that you'd need when your second-innings begin.

Why waste in such a haste? Think Long Term!

No comments:

Post a Comment